All Categories

Featured

Table of Contents

[/image][=video]

[/video]

The even more you take into it, the more you go out. Overfunding brings about higher cash money worths and returns, turning your plan into a powerful financial tool. Overfunding your plan is merely an additional means of stating the objective must be to optimize cash money and reduce fees. You ought to recognize. If you pick a shared insurer, the money will have a guaranteed rate of return, however the assured rate will not suffice to both sustain the long-term insurance coverage for life AND create a constant policy finance.

This does not mean the approach can not work. It merely implies it will not be ensured to function. Assurances are expensive, threat is free. You life insurance policy cash money development in a common life insurance policy company will certainly be proclaimed every year, is subject to alter, and has averaged in between 3.5-5.5% after fees.

Any correctly designed plan will consist of making use of paid up additions and could likewise assimilate some non commissionable insurance policy to further reduce thew fees. We will certainly chat more concerning PUA motorcyclists later, yet understand that a comprehensive conversation in this tool is difficult. To dive much deeper on PUA bikers and various other ways to minimize costs will call for a thorough face to face discussion.

You're about to open the power of leveraging equity from this personal bank. Obtain against your cash money surrender worth. The appeal below lies in the adaptability it offers you can make primary and rate of interest payments on any timetable wanted or pay nothing until able to make a balloon repayment.

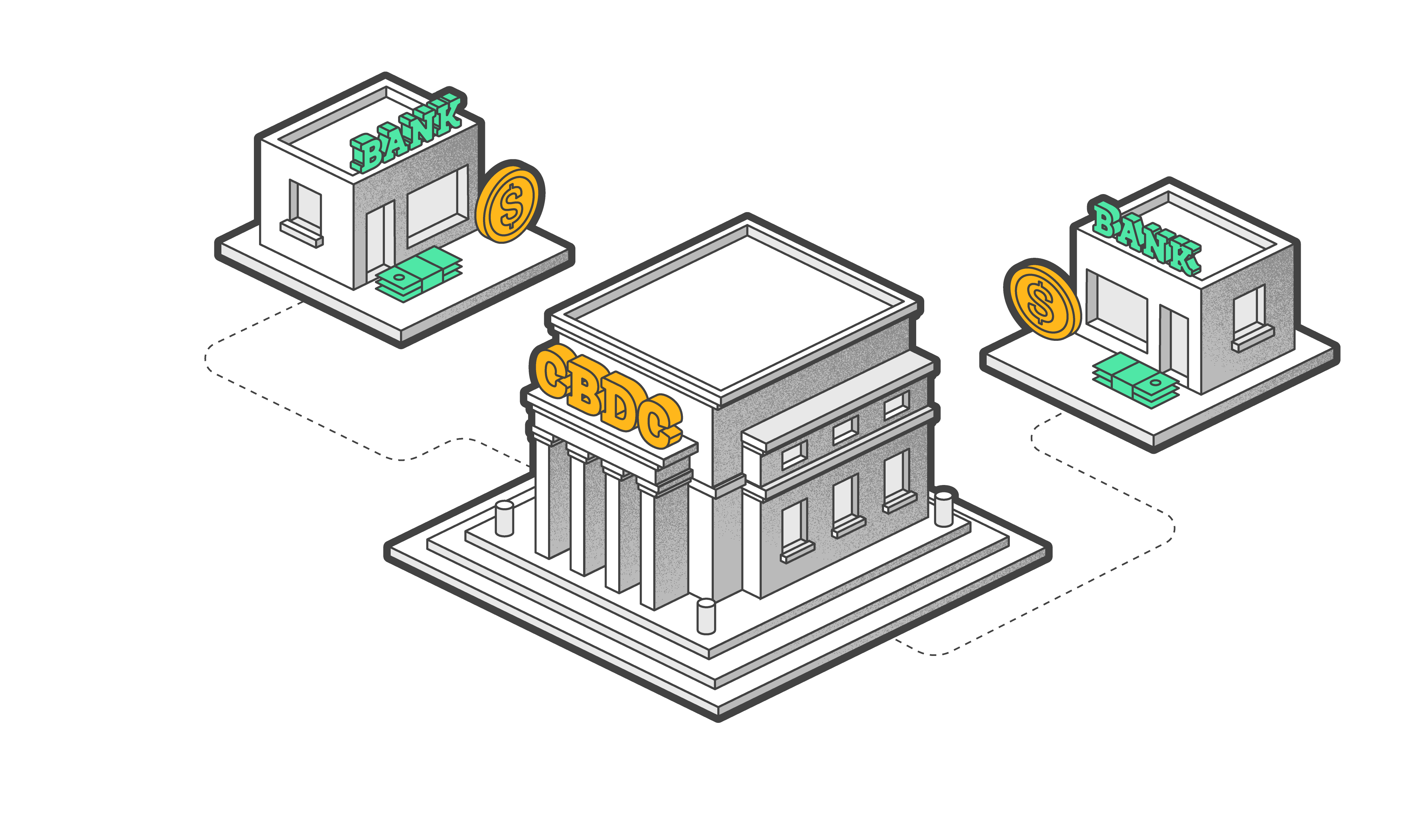

Become Your Own Bank

Having the ability to manage when and just how one pays back a lending is important, enabling better versatility than standard loans supply. Whole life insurance policy plans, unlike conventional loans, enable exceptionally adaptable payment timetables. The purpose below is not only to utilize but also manage this asset successfully while appreciating its advantages.

Unlike term policies that provide coverage just for collection durations, cash-value policies are below to stay. One of the most considerable benefits of a cash-value plan is the tax-free growth within permanent plans.

By leveraging PUA motorcyclists properly, you can not just raise your policy's money value however likewise its future reward capacity. If you're interested in adding PUAs to your policy, merely reach out to us.

It needs a solid understanding of your monetary commitments and clear goals. Be particular of what you're accepting. The costs aren't exactly pocket modification, and there are potential liquidity risks involved with this technique. Particularly in the very early years. In truth, I'll simply proceed and excuse half the space now.

Infinite Banking Concept Review

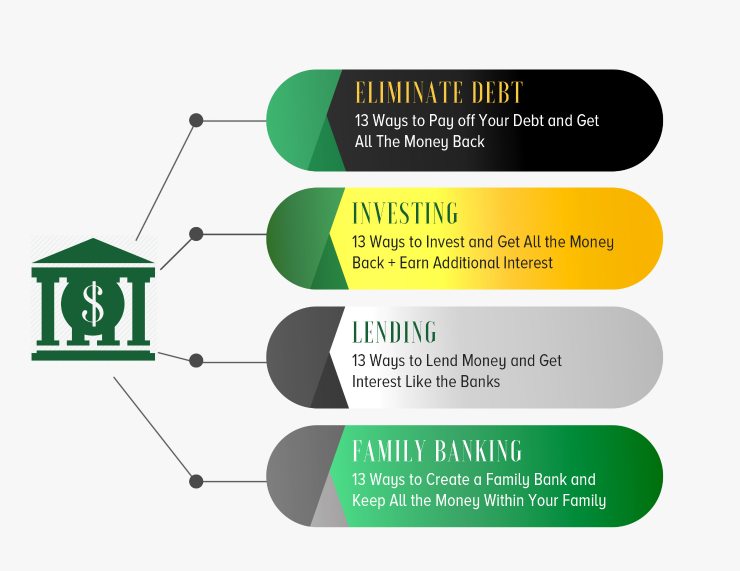

This has to do with setting practical monetary goals and making notified decisions based upon those objectives. If done right, you might create a different financial system using whole life insurance plans from shared insurance providers providing long-lasting coverage at low-interest rates contrasted to conventional lenders. Since's something worth thinking about. Overfund your Whole Life Insurance policy to boost cash money worth and dividends, after that borrow against the Cash Surrender Value.

Allows policyholders to purchase sub-accounts, similar to common funds. Typical financial investments that use potential for growth and income. Can supply rental revenue and recognition in worth. 401(k)s, IRAs, and other retirement accounts use tax benefits and lasting development potential. High-income earners can become their very own bank and produce substantial money circulation with permanent life insurance policy and the infinite financial technique.

For more details on the limitless banking strategy, begin a conversation with us right here:.

How To Become Your Own Bank And Build Wealth With ...

Attempt to become remarkable. If you are battling financially, or are worried concerning just how you could retire one day, I believe you might locate some of my over 100 FREE helpful.

You an also get a quick introduction of our ideology by having a look at our. If you require a that you can really sink your teeth right into and you agree to stretch your convenience area, you have concerned the appropriate area. It's YOUR cash. You are in control.

How To Start Infinite Banking

Regretfully, that lending against their life insurance policy at a higher rates of interest is mosting likely to set you back even more cash than if they hadn't moved the financial debt at all. If you wish to use the strategy of becoming your very own banker to expand your wealth, it is essential to recognize exactly how the strategy actually works before obtaining from your life insurance policy policy.

And incidentally, whenever you obtain money constantly ensure that you can make more cash than what you need to pay for the loan, and if you ca n'tdon't obtain the cash. Seeing to it you can gain even more money than what you have actually borrowed is called developing totally free capital.

Totally free cash circulation is even more crucial to developing riches than buying all the life insurance coverage on the planet. If you have inquiries about the legitimacy of that statement, study Jeff Bezos, the creator of Amazon, and discover why he thinks so highly in complimentary cash money circulation. That being stated, never ever take too lightly the power of owning and leveraging high cash value life insurance to become your very own banker.

Discover The Perpetual Riches Code, a very easy system to maximize the control of your financial savings and lessen penalties so you can keep even more of the cash you make and construct wide range each year WITHOUT riding the market roller-coaster. Download and install here > Example: "I believe it's the smartest means to work with money.

This begins with the style of your policy and includes the use and management of each life insurance plan that you have. Lots of people are losing cash with typical economic planning. Also people that were "set for life" are lacking money in retired life. Below's an easy overview with 3 points you can do to become wealthier.

Private Banking Concepts

Tom McFie is the owner of McFie Insurance policy which assists individuals maintain even more of the cash they make, so they can have economic comfort. His most recent book,, can be purchased below. .

Person A-saver ($10,000 each year) and then spender for things we require. Your Interest-bearing Accounts Balance at a financial institution (you do not own) is $10,000. They are paying you 0.5% interest per year which makes $50 per year. And is strained at 28%, leaving you with $36.00 You determine to take a loan for a new made use of cars and truck, as opposed to paying cash, you take a lending from the financial institution: The financing is for $10,000 at 8% rate of interest repaid in one year.

at the end of the year the passion expense you $438.61 with a repayment of 869.88 for 12 months. The Financial institution's Earnings: the difference between the 438.61 and the $36.00 they paid you is $402.61. Simply put, they are making 11 times or 1100% from you all while never ever having any of their cash at the same time.

Unless you wish to obtain from them once again. Think of this for a moment. Why would certainly you do that if you understood a much better way? Like end up being the owner of the device the financial institution. Likewise, let's bear in mind that they don't have any type of money purchased this equation. They simply lent your refund to you at a higher rate.

Infinite Bank Statements

If you borrow you pay passion, if you pay money you are quiting rate of interest you can have made. In any case you are surrendering rate of interest or the prospective to receive interestUnless you own the financial feature in your life. After that you obtain to keep the car, and the concept and interest.

Think of never having to fret about financial institution lendings or high rates of interest again. What happens if you could borrow cash on your terms and construct riches simultaneously? That's the power of limitless banking life insurance. By leveraging the cash worth of entire life insurance policy IUL policies, you can expand your wide range and borrow cash without depending on traditional financial institutions.

Table of Contents

Latest Posts

Review Bank On Yourself

Infinite Income Plan

Cash Flow Banking Insurance

More

Latest Posts

Review Bank On Yourself

Infinite Income Plan

Cash Flow Banking Insurance